We are experiencing an increased number of annuity enquiries, typically from clients who want a secure pension, but the ‘shape’ of their scheme pension doesn’t fully meet their needs. By using their Defined Benefit (DB) fund value to purchase an annuity, they can obtain a secure income in a way that could provide more value for themselves and their family;

- It may be that the scheme pension is Joint Life and the client is single, or it may be that the client has a partner but is concerned that the scheme pension will only pay a 50% taxable dependents pension on their death.

- They may wish to explore the option of taking a level pension rather than an increasing one to provide a higher income in the earlier years when they are more likely to be fit and well.

- They may not be in good health or have lifestyle issues and can benefit from enhanced annuity rates.

- The scheme commutation factors may be relatively poor and an annuity alongside a larger PCLS may meet a lump sum need.

- There is also increasing interest from clients who have dependency on the scheme pension, but all of the income from the scheme is not required to meet their outgoings. Some schemes now offer numerous options on how benefits can be taken. They may offer ‘split’ transfers (i.e. a secure pension from the scheme and a partial transfer into another type of pension). Where this is not available, there may be a suitable solution available through a mix of annuity and personal pension.

To help you with any initial discussions you have with clients about their alternative options to drawing a scheme pension, we have produced the following Scheme Pension vs Annuity comparison calculator. Please click on the following link below to download our current version of this calculator, which we will update from time to time with the latest annuity rates;

Scheme Pension vs Annuity Calculator 02/11/23

Operating Instructions

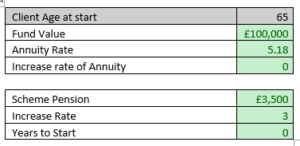

To use this calculator, you will first need to complete the green boxes with the relevant information. Please see an example of this below. Please use the dropdown to select your client’s age then enter the fund value (transfer value), the appropriate annuity rate from rates provided, and the increase rate of the annuity. Please leave this as ‘0’ if you wish to compare to a level annuity.

Please then enter the gross amount of the scheme pension, the increase rate (defaulted to 3%) and, if your client does not intend to take this immediately, enter the number of years before it will start;

Once the figures have been entered for your client the calculator will then produce for you the Catch Up age (this is the age at which the annual scheme pension income overtakes that of the annuity, if this is initially higher) and the Breakeven Age (the age when the total scheme income cumulatively overtakes that of the annuity).

You can then click on the charts tab that will illustrate this information for you.

If you have any questions, please feel free to call our Business Relationship Manager, Graeme Fountain, on 07754 970 536 .

Notes

For most consumers it’s not in their best interests to transfer out of a Defined Benefit (DB) pension

The above calculations are based on an actual transfer value and the corresponding scheme pension. The Annuity rates are based on available products (Source: Just Retirement )

We have assumed the scheme pension will increase at 3% per annum. It will however be index linked. It could increase at a higher or lower rate than this over the period it would be in payment.

None of these figures are guaranteed and should not be relied on to provide advice.

Transfer values and annuity rates change frequently, and these changes can be significant.

The contents of the above are for professional introducers and do not constitute financial advice.